GST - Rate of Tax Exemptions. Seller transferor or issuer as the case may be shall be liable to pay stamp duty.

Save On Taxes With Eztax In Filing Taxes Income Tax Return Income Tax

In this article we describe briefly the tax code in Singapore.

. GST - Schedules to the CGST Act. The value of stamp paper on which the LLP agreement must be printed or stamp duty to be paid on the LLP agreement is dependent on the state of incorporation and amount of capital contribution from the partners. 015 of authorised capital subject to a maximum stamp duty of rs.

UTGST - Effective Ntfs. In case of sale transfer or reissue. Stamp Duty payable of LLP Agreement is different from state to state and is as per the State Stamp Act.

City Stamp Duty Charges. Rs 5000000 Stamp Duty in MP 750 of propertys cost Rs 375000. Goods Service Tax.

Stamp duty rates from January 1 2021 till March 31 2021. Male 6 of the consideration amount or the circle rate of the property applicable in the area whichever is higher Female 4 of the consideration amount or the circle rate of the property applicable in the area whichever is higher Bangalore. As mentioned above a delay in the payment of stamp duty will attract a penalty of 2 every month up to 200 of the remaining amount.

Stamp duty on Share certificate is State subject But Stamp duty on Debenture Certificate I Union subject. It should be for consideration. Whether stamp duty will be payable again when duplicate or split Share Certificate is issued.

Stamp duty shall be. CGST - Effective Ntfs. CGST Rate - Effective Ntfs.

Lets understand with an example how the stamp duty and registration charges in Madhya Pradesh are calculated. Thanks for explaining the relationship stamp duty and GST. Rate of Stamp Duty will be 0005 of the market value both for shares and debentures.

Stamp duty rates differ in various states across the country as stamp duty in India is a state subject. GST - Effective Notifications. RevenueSA Ground Floor State Administration Centre 200 Victoria Square Adelaide SA 5000 P.

Is ruled by the Income Tax Act ITA the Economic Expansion Incentives Act EEIA the Goods and Services Tax GST Act and the Stamp Duties Act. UTGST Rate - Effective Ntfs. If the shares of the company are listed in a recognized stock exchange then the company cannot charge any fee for the registration of transfers of.

Explore Income Tax GST TDS tools calculators to help you stay on top of your finances by Team Quicko. If I paid 20000 stamp duty on the purchase of a property I would probably put this to. In this case the board may register the transfer on specific terms of indemnity as it thinks fit.

PublishedAug 08 2022 1630. Total Cost The above mentioned government fee has been calculated on minimum contribution of. Further bituminous or oil shale and tar sands bitumen and asphalt natural asphaltites and.

The stamp duty must be paid no later than 14 days after. GST - Advance Rulings. Any delayed payments will have 2 as a penalty every month.

Such delays in payment can make the individual liable to pay a hefty fine ranging from 2 to 200 of the total payable amount. Stamp Duty in Maharastra. Stamp duty rates applicable wef.

015 of amount of increase in authorised capital subject to maximum of rs. The PEXA fee is separate from the statutory lodgement fees which are set by each jurisdictions Land Registry. Stamp duty rates applicable wef.

From my understanding these stamp duties imposed are related to income generating purpose. As per Regulation 25 of Schedule I of Indian Stamp Act stamp duty payable on counterpart of duplicate of an instrument is maximum One Rupees. Stamp duty rates from September 1 2020 till December 31 2020.

Stamp Duty on LLP Agreement. Besides this the stamp duty charge also depends if a property is old or new. Stamp Duty to be paid on the consideration specified in the instrument For example SH-4 4.

GST Case Laws. PAN and TAN Fees. However the central government fixes the stamp duty rates of specific instruments.

Delhi section 8 companies 10. Stamp Duty in Maharashtra OTP Window. GST - FAQs Manual.

Stamp duty verification with the duty authority. 08 8226 3750 Stamp Duty - General stampssagovau. 6-XXXX with a FRE code.

If you buy a house youll have to pay Rs 525 lakh in stamp duty and registration charges on a property worth Rs 5000000. But my question is more about the stamp duty and income tax destructibility. GST rate on sand is fixed at five percent.

GST - Item wise list. The stamp duty is to be made by the purchaser or buyer and not the seller Ask Free Legal advice. IGST Rate - Effective Ntfs.

Other than metal bearing sand fall under chapter 26 of the HSN code. Enter Mobile Number OTP and captcha code. PEXA transactions service fees including GST Single Title Multiple Title Transfer Titles 12397 14190.

April 1 2022 for men. April 1 2022 for women. Stamp duty for LLP agreement has to be borne by the applicant.

The main provisions of the Singapore Income Tax Law. 25 lakhs of stamp duty. Documents that require stamp duty.

It differs from one state to the other. Cost of the property. Know the property registration charges in Maharashtra and stamp duty in Mumbai and suburbs Nagpur and other rural urban areas.

IGST - Effective Ntfs. Delhi companies not having share capital other than section 8 10. All You Need to Know.

6 includes 1 metro cess 5 includes 1 metro cess 2. GST Registration Optional Free. As per the Indian Penal Code not paying the required stamp duty is a criminal offence.

Male Female or Joint owners regardless of gender 5 on properties above Rs. Affix the same value stamp on a written application if the signed transfer deed has been lost. The central government of India fixes the registration and stamp duty charges.

Stamp duty and registration charges in Mumbai Aug 01 2022 329067 Views. The calculation of stamp duty is not the same for all places in India. Cost of constructing a house in India Aug 01 2022 258289.

Gift Deed Drafting Registration Stamp Duty Tax Implication And Faq Video Video Essential Elements Legal Services Stamp Duty

Gift Deed Drafting Registration Stamp Duty Tax Implication And Faq Video Video Essential Elements Legal Services Stamp Duty

Gst On Stamp Duty Payable On Mining Lease

Gst Implications In Case Of Joint Development Agreements

Gst Goods And Services Tax Meaning Full Form Types Housing News

Kbc Helpline Whatsapp Number 9313473098 Online Customer Service Customer Care How To Apply

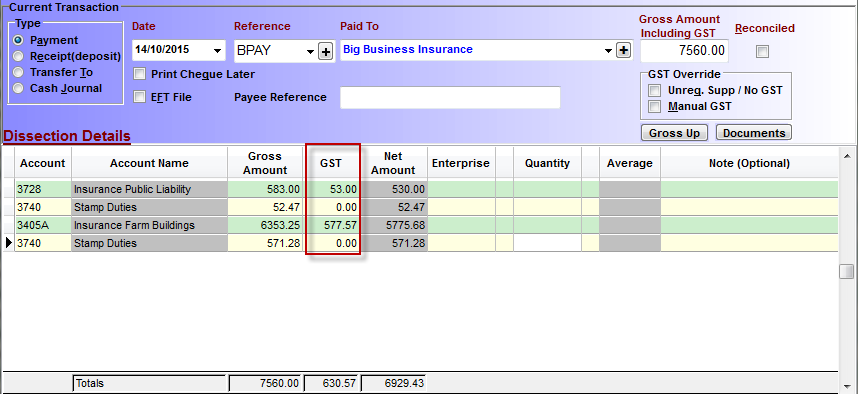

Xero Bas Which Xero Gst Tax Rate To Use For The Stamp Duty Part Of An Expense Youtube

Save On Taxes With Eztax In Filing Taxes Income Tax Return Income Tax

Pin By The Taxtalk On Income Tax In 2021 Memes Coding Income Tax

Gst Rates Hsn Code On Printing Services Newspapers Brochures

Raunak Surpreme Codename Raunak Liv Large Floor Plans

Goods And Services Tax Definition Timeline Compliance And More

Lodha Gardenia Residences Mumbai Ad Toi Mumbai 10 10 2020 Real Estates Design Real Estate Brochures Real Estate Advertising

Gst State Code List And Jurisdiction Housing News

Gst Free And Non Reportable Ps Support

Gst On Agreement Value Or On Stamp Duty Value

Cha कस टम ह उस एज ट Custom House Agent क क य र ल ह त ह In Hindi Banks Ads Import Business Online Business